You know what I hate?

Those social media threads with titles like “The 10 Essential Books to Become a Multimillionaire” or “Wealth Secrets the Elites Don’t Want You to Know,” and then it’s just a list of ultra-generic personal finance books like Rich Dad Poor Dad or The Richest Man in Babylon.

While these books aren’t terrible, they’re so elementary and surface-level that there’s no real edge in reading them. They cover broad, basic concepts rather than specific, practical wealth-building skills.

“Pay yourself first” is nice advice, but it isn’t actionable in the same way that learning how to evaluate a stock is.

So why bring this up? Because today’s special report does cover a broad-brush personal finance concept from a Robert Kiyosaki book. Specifically, the “Cashflow Quadrant” from Rich Dad’s Cashflow Quadrant: Guide to Financial Freedom.

This is an incredibly useful framework for thinking about money.

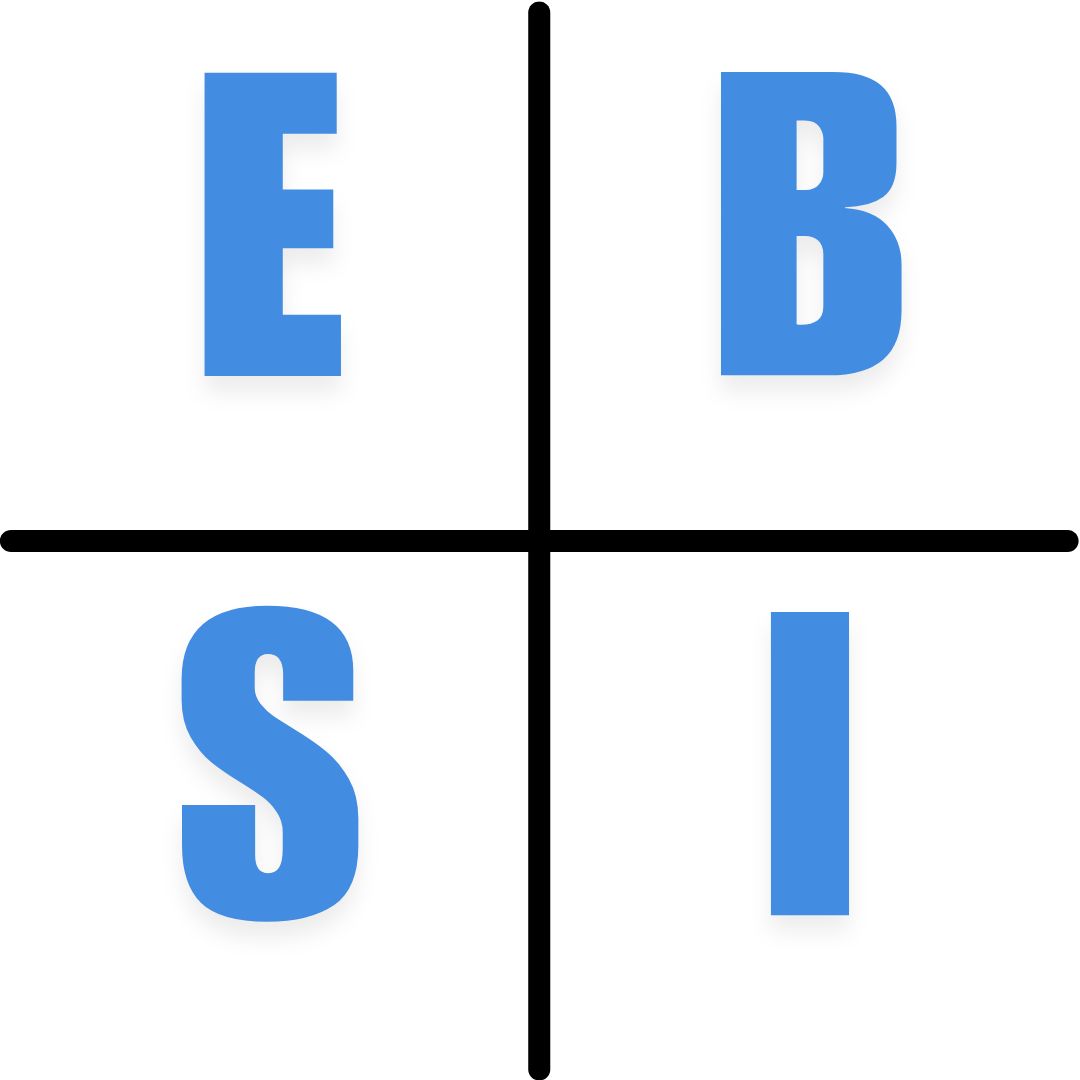

Here’s what the quadrant looks like (designed in Canva by yours truly):

Employee: You trade time for money.

Self-Employed: You trade time and effort for money.

Business Owner: Your employees produce your income.

Investor: Your assets produce your income.

Everything on the left side of the quadrant involves actively trading time and effort for money. Everything on the right side focuses on building passive income streams, where your assets do the work for you.

With few exceptions, most employees are constrained by pre-arranged salary ranges and a finite number of promotions.

Being self-employed, and this is from personal experience, is often worse. When a self-employed small business owner stops working, their income stops too.

In either case, both employees and the self-employed face hard limits on their income.

The right side of the quadrant is different.

A business owner manages employees or technology and can leverage these assets for greater profits.

Imagine owning a small coffee stand and paying one employee $10 an hour. That employee sells an average of $50 worth of coffee per hour. Everything beyond the $10 wage and a few fixed business expenses is profit.

Investors benefit in a similar way. By owning stocks or real estate, they own a slice of a productive business or property that pays dividends or rent.

If you want to build wealth, it’s important to focus on “right side” activities like creating a scalable business or investing in productive assets. These allow you to transcend trading time for money and let employees, systems, and assets do the heavy lifting for you.

3 Tricks Billionaires Use to Help Protect Wealth Through Shaky Markets

“If I hear bad news about the stock market one more time, I’m gonna be sick.”

We get it. Investors are rattled, costs keep rising, and the world keeps getting weirder.

So, who’s better at handling their money than the uber-rich?

Have 3 long-term investing tips UBS (Swiss bank) shared for shaky times:

Hold extra cash for expenses and buying cheap if markets fall.

Diversify outside stocks (Gold, real estate, etc.).

Hold a slice of wealth in alternatives that tend not to move with equities.

The catch? Most alternatives aren’t open to everyday investors

That’s why Masterworks exists: 70,000+ members invest in shares of something that’s appreciated more overall than the S&P 500 over 30 years without moving in lockstep with it.*

Contemporary and post war art by legends like Banksy, Basquiat, and more.

Sounds crazy, but it’s real. One way to help reclaim control this week:

*Past performance is not indicative of future returns. Investing involves risk. Reg A disclosures: masterworks.com/cd

Disclaimer: This article is for entertainment purposes only. It is not financial advice, always do your own research.